You Made it to Ride Free Fearless Money!!

Be honest: for most of us, money is loaded.

REALLY LOADED.

- Whether you have money or don’t

- Whether you have loans or debt or wealth

- Whether you believe you should or shouldn’t want money, or do or don’t deserve money

- Whether you’re a freelancer, an employee (or both!), or not working

- Whether you’re sorting money with a partner, a roommate, a collective, or just on your own

But!

Handling your money and sorting your finances will make your life less stressful. And,

You can make your financial life work better and be in line with your values!

I see people doing it every day, and I learned how to do it too.

Hi, I’m Hadassah Damien.

I write this blog, teach classes for individuals and organizations, share online classes, coach business owners and people in financial transition, design custom workshops, and write guides and ebooks for people who want to change their actions and relationship to money without throwing their values out the window.

What you’ll find here at Ride Free Fearless Money:

- Tips and tricks to survive and thrive in this wild world: money blog & financial resources & a podcast

- Fearless money management live finance classes for individuals, couples, freelancers, and you great weirdos.

- Fearless Money Course Lab: on-demand online classes

- Group coaching for accountability and get-sh#t-done

- One on one coaching: 1-to-3 month-long packages

- A bi-monthly newsletter with resources, media, ideas and cute quotes

~ Popular Posts ~

- Buying property is popular these days

- A lot of people are into the Money Hacks + Hacking Capitalism series, and you want to know how to make divesting worth your time.

- Many folks also enjoy the article on using and creating sliding scale.

- Lots of you read about ethical investing and sharing money

- …and people seem to love stories about my sordid 20s. 😉

I want you to stabilize your money because:

One less stress point means you can do more of what you’re actually on the planet to do (hint: it’s not to balance a checkbook.)

Especially for women, queer folks, people of color, artists – we all deserve stability.

Stabilize it now because interest adds up and I want you to take care of yourself and your communities — not big banks.

Ready to be proactive on your finances? I got you. Read up, grab a free e-course, talk about it, take a video class, reach out for one-on-one help, or learn more right this moment:

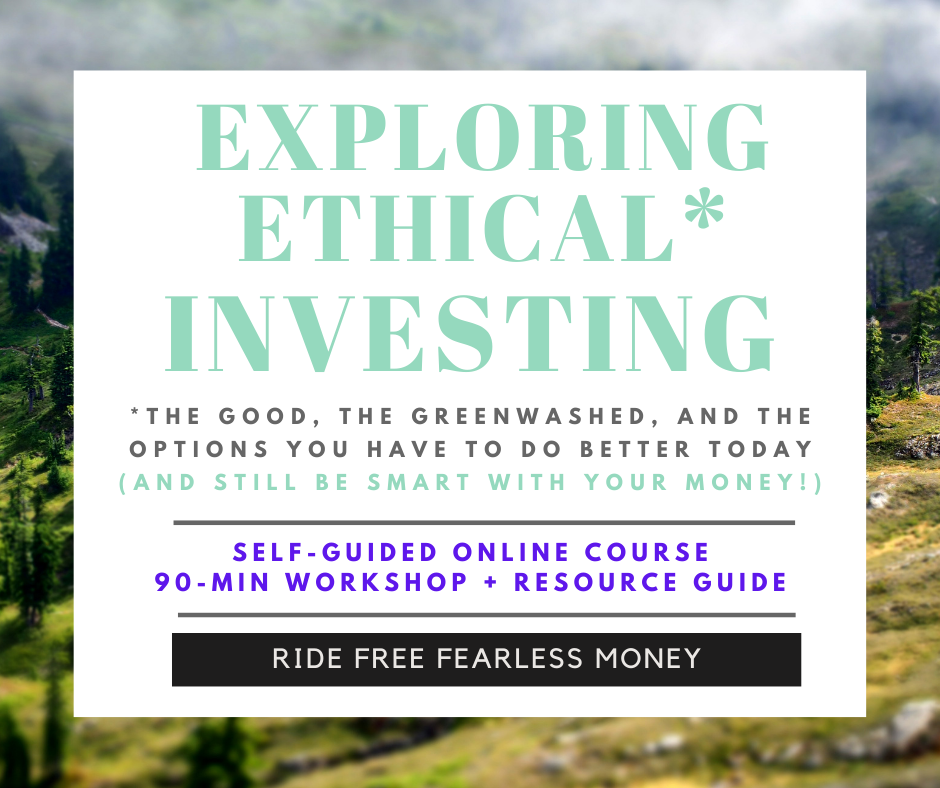

Investing for your Financial Future (Without Ruining Everything)

In this self-guided digital course, learn about the options and limits of more-ethical investing options, as well as how to get yourself going to invest for your future.

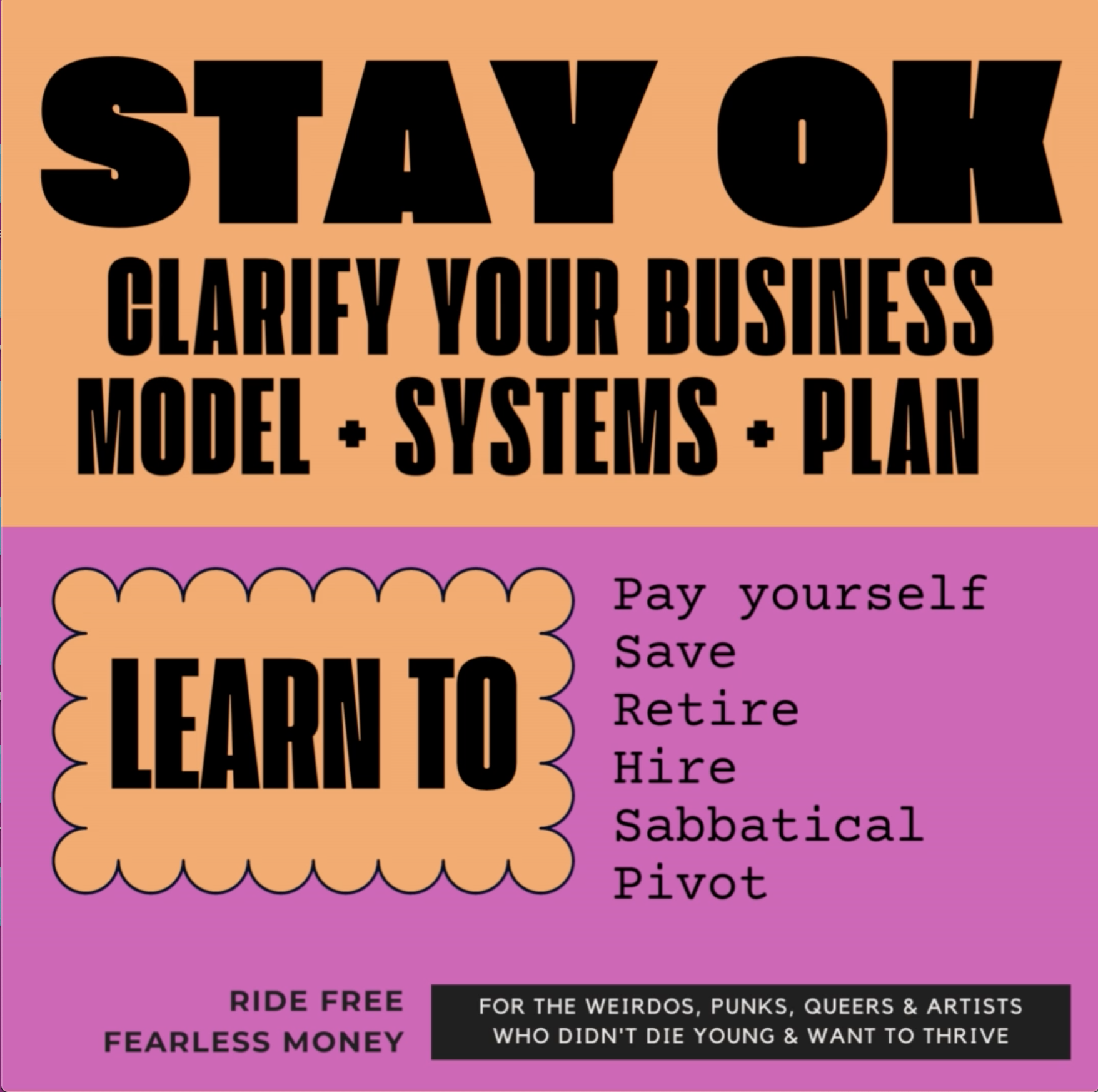

For Freelancers & Small Business Owners

Learn how to Price Your Work For Sustainability:

Fearless Freelancer Small Business Money Skills Online Course

For Partners of all kinds (romantic, platonic, two, three, more!)

Partners Make Peace and Plans with Money Toolkit

For individuals starting to get a grasp and take control of your finances

NEW YOU $49 SALE!

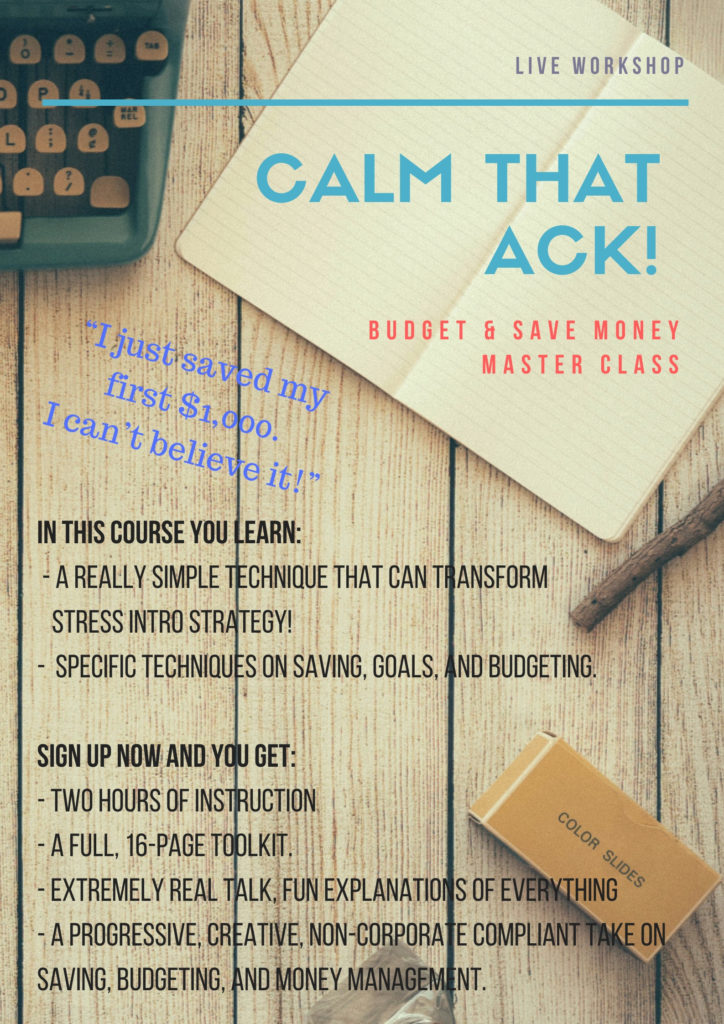

Calm That ACK! Budget & Save Money Online Course

It can be challenging to engage about finances, because money isn’t a neutral topic. It’s loaded with assumptions, with opportunities, with experiences. It can bring up fear, sadness, shame, pride, excitement. Money touches buttons related to class, family, culture, need, desire.

Furthermore, at least in many communities I’m part of, sharing about personal finances and any relationship to money means having to do a careful dance around the elephants of capitalism, globalization, gentrification and greed. Money has become equivalent with systemic decimation.

However, not talking about money – and not dealing with our money [or money problems] doesn’t halt systemic decimation. Instead, the WASP-y middle-class value of silence takes the place of useful information — information which might help make lives less stressful and more sustainable. Information which put you in the drivers’ seat.

So, saying “money is not neutral” is perhaps, an understatement.

I should know: I was raised by a single mom and we lived below the poverty line. I went to community college, then to the University of Toronto. I stayed in Canada afterwards doing medical tests for money and avoiding my student loan default calls. When I returned to the US, I realized if I wanted a life that wasn’t ruled by money stress and fear, I had to get my financial self together since I have no family net to fall on. I dealt with my loans, started a business, cleaned up my credit, committed to saving — and even though I earn a nonprofit-level salary I’m working on buying a house.

I taught myself how to be fearless about money by learning how it works.

And the more I tell people my stories, the more I’ve been asked HOW?

- How did I clean up my credit?

- How did I save a down payment?

- How did I get a motorcycle while I was not at a salaried job?

- How do I use money in line with my values?

- How do I run three businesses and excel at my dayjob?

Ready to get your fearless self on?

I want people who feel discouraged, overwhelmed, confused, or disempowered about their financial situations to have a chance to do right by themselves. I want folks who are movers and shakers to be able to create solid financial bases to be their baddest and most brilliant from. I’m especially excited to work with progressive groups, “nontraditional” couples, women and LGBTQI people.