The content of this page is not applicable to the region where you are located. The Stripe Legal page for your region is available at https://stripe.com/legal/ssa.

Last updated: December 4, 2023

Stripe is an Irish-American financial services and software as a service (SaaS) company dual-headquartered in South San Francisco, California and Dublin, Ireland. Stripe is a technology company that builds economic infrastructure for the internet. Businesses of every size, from new start-ups to public companies, use Stripe’s software to accept online payments, send payouts, manage their business online and run technically sophisticated financial operations. Stripe helps new companies get started and grow their revenues, and established businesses accelerate into new markets and launch new business models. Over the long term, Stripe aims to increase the GDP of the internet.

The tax strategy below applies to Stripe’s UK group companies and affiliates. It has been published in accordance with paragraph 22(2) of Schedule 19 to the Finance Act 2016. The tax policy covers both direct and indirect taxes, including corporate tax, PAYE and VAT.

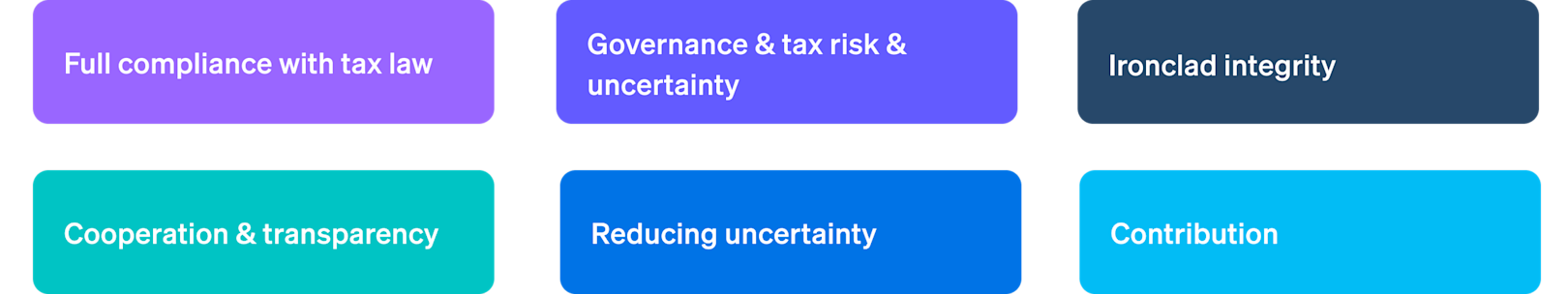

Stripe’s UK Tax Strategy is based on six key principles:

1. Full compliance with applicable tax laws

Stripe’s approach to tax is compliance with all tax laws in the jurisdictions where we operate, including the UK. Stripe takes its tax obligations seriously and completes all reporting, filing and payment obligations in an accurate and timely manner. To make the right decisions, we hire professionals who not only excel in tax technical skills but are also humble people who hold high standards of integrity. Tax policy is constantly evolving and our teams are appropriately qualified, work hard, and use qualified outside consultants as needed, to stay up-to-date with developments in tax laws and to accurately, completely, and timely file our tax returns and reports.

2. Governance, tax uncertainties and risk management

Stripe works to maintain an appropriate organisational structure to manage the group’s tax affairs, including its UK tax affairs, and to ensure processes are in place to monitor, identify, assess and report material tax uncertainties and risks. We are constantly building and evolving robust processes, systems and controls to manage our tax risk. We engage with reputable advisors to seek advice on UK tax matters and we seek to proactively identify uncertainties and risks and develop controls to mitigate these uncertainties. When a tax uncertainty or risk is identified, Stripe’s procedures require escalation and prompt notifications to appropriate senior personnel and executives. We not only implement controls to fix potential identified issues but are also committed to correcting errors once identified. Establishing and maintaining a well-respected reputation for tax compliance is paramount and properly managing tax uncertainties will always remain a priority of the Stripe tax team.

3. Ironclad integrity

Stripe tax personnel operate with strong moral compass and integrity and in a manner consistent with our regulatory licenses, approvals, permissions and requirements imposed by our financial partners.

Stripe’s tax positions, including those in the UK, appropriately reflect the business activities it undertakes globally and within each country in which we operate. Stripe does not engage in aggressive tax planning or artificial transactions that lack commercial purpose or economic substance and Stripe pays tax and allocates profits based on where functions are performed and value is created. Stripe does not accept any form of behaviour that risks Stripe’s reputation with our users, financial partners, regulators, tax authorities, or the general public.

4. Cooperation and transparency

At Stripe, we strive to develop professional, respectful, and transparent relationships with HMRC. We aim to work collaboratively with HMRC and we are committed to resolving disagreements through open discussions and in a spirit of cooperative compliance. While we will always cooperate respectfully with HMRC, where disagreements arise, we will assert necessary legal rights and remedies to uphold our positions based on our interpretation of the law.

5. Reducing uncertainty where appropriate

Stripe strives to reduce uncertainty in our tax matters with regard to interpreting various tax laws, including by seeking guidance from tax authorities themselves. This may also include the use of tax forums, industry associations, legal opinions and other appropriate measures allowed by law. These efforts are supported by our collaborative approach and relationships with governmental bodies.

6. Contribution

Above all, Stripe wants to create a better environment for others. Stripe actively tries to make the culture around us better and we want to do everything we can to facilitate the success of our users. The Stripe tax team constantly works and participates in the development and operation of products, such as Stripe Tax, that assist our users with their tax compliance and reporting obligations.

This strategy has been published for the year ended 31 December 2023.